STOCK MARKET REPORT by CEO Silvano Grimaldi of the independent asset management company GRIMALDI & PARTNERS Ltd.

STOCK MARKET REPORT by CEO Silvano Grimaldi of the independent asset management company GRIMALDI & PARTNERS AG

MONTHLY REVIEW

The international stock markets ended the month of JANUARY with losses.

STRESSING FACTORS:

- The looming military conflict between Russia and Ukraine.

- Investors fear that the US Federal Reserve, which sets the tone, could raise interest rates faster and more than expected to combat the significant price increases.

EQUITIES in focus:

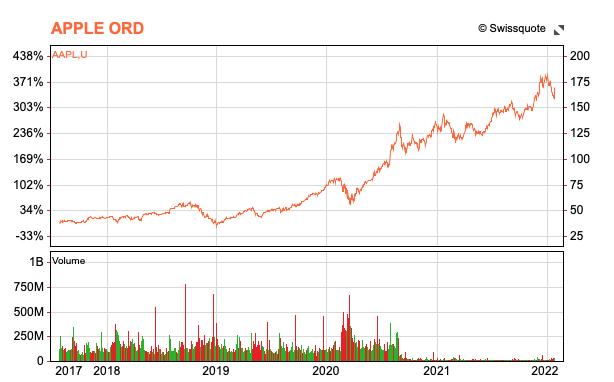

APPLE with record Christmas quarter despite chip shortage

Despite the global chip shortage, Apple once again achieved record numbers last Christmas. The quarterly profit reached 34.6 billion dollars (31 billion euros). That was a good fifth more than a year earlier. Sales rose by around eleven percent to 123.9 billion dollars (111.2 billion euros), also a record. The group could have sold even more without the chip bottlenecks: Apple estimates that they pushed sales by more than six billion dollars.

The iPhone was once again the growth driver. Sales of Apple's smartphone rose to $71.6 billion year-on-year, Apple announced after the US stock market closed on Thursday. That was an increase of nine percent year-on-year - significantly more than analysts had expected.

MICROSOFT exceeds expectations with quarterly figures

Microsoft exceeded market expectations with its figures for the past quarter. The software giant increased sales year-on-year by a fifth to $51.7 billion (45.7 billion euros). Analysts had expected around $ 50.9 billion. The bottom line is that Microsoft earned just under $18.8 billion in the second quarter that ended in December - an increase of 21 percent.

The cloud business was once again a growth driver. Revenues there rose by 32 percent to $22.1 billion, as Microsoft announced after the US stock market closed on Tuesday. Microsoft also launched its new Windows 11 operating system earlier in the quarter. Revenues in the Windows business with PC manufacturers grew by a quarter, it said.

MONTHLY OUTLOOK

Contrary to historical statistics, January was weak. Concerns about interest rates and the looming conflict between Russia and Ukraine had a decisive influence on this. Now the share prices are in the oversold area after the sell-off. However, the quarterly figures have so far been very positive. There is too much pessimism at the moment. This provides a good starting point for a strong recovery. Whether it will be sustainable will likely depend on whether central banks manage to contain inflation without aggressively raising interest rates.

We expect a slight upward trend for February.

STOCK RECOMMENDATION