STOCK MARKET REPORT by CEO Silvano Grimaldi of the independent asset management company GRIMALDI & PARTNERS Ltd.

STOCK MARKET REPORT by CEO Silvano Grimaldi of the independent asset management company GRIMALDI & PARTNERS Ltd.

MONTHLY REVIEW

The international stock markets ended the month of OCTOBER with gains.

DRIVING FACTORS

- The hope of a slower rate of interest rate hikes by the central banks in the near future .

- The hope of a mild downturn in the US economy and the global economy as a whole.

- Speculations about a move away from the Chinese regime's zero-Covid policy.

EQUITIES IN FOCUS

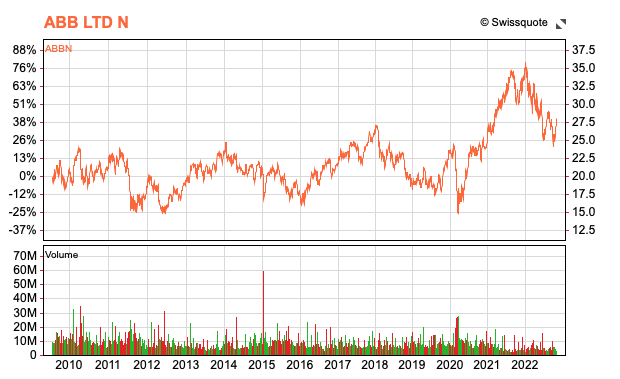

ABB increases pace of growth in third quarter

ABB continues to move at a brisk pace. Thanks to a certain relaxation in the supply chains, sales grew even faster in the third quarter than in the second. However, the net profit was significantly below the previous year due to a one-off charge.

In the third quarter, sales and incoming orders were primarily slowed down by currency effects and secondarily by the usual smaller portfolio changes. However, both values clearly increased compared to the previous year. If the negative influences are factored out, both sales and orders showed clearly double-digit growth rates.

Margin reaches "historically high" level

In this environment, operating profit (EBITA) climbed 16 percent year-on-year to $1.23 billion and the corresponding margin rose 1.5 percentage points to a "historically high" figure of 16.6 percent, according to ABB.

Net income, on the other hand, fell by almost half to $360 million. However, a one-off effect played a role here. As announced in late September, approximately $325 million was accrued in the third quarter for an older legal case in South Africa.

ABB is quite confident about the outlook. For the fourth quarter, a low double-digit growth rate for comparable sales was forecast, as well as a lower operating margin compared to the third quarter due to the seasonal development. The goal of an operating profit margin of at least 15 percent, which was only formulated for 2023, should also be achieved in the current year.

MONTHLY OUTLOOK

September «flop», October «top». The past month has shown itself from the strong side. All major markets have recovered from the mid-October lows. Investors are now saying that the recovery that has started could be the start of a bull market. The coming weeks will provide more clarity as to whether we are not in a bear market rally again. In any case, a lot of negative things have already been priced into share prices this year.

We expect the positive trend on the stock markets to continue in November.

STOCK RECOMMENDATION

© 2022, Grimaldi & Partners Ltd.