STOCK MARKET REPORT by GRIMALDI & PARTNERS

LAST MONTH REVIEW

The international stock markets ended October with gains.

DRIVING FACTORS:

- Mostly positive company figures for the third quarter.

- The economic recovery in the US due to the rise in employment.

Particularly noticeable at TITLE LEVEL:

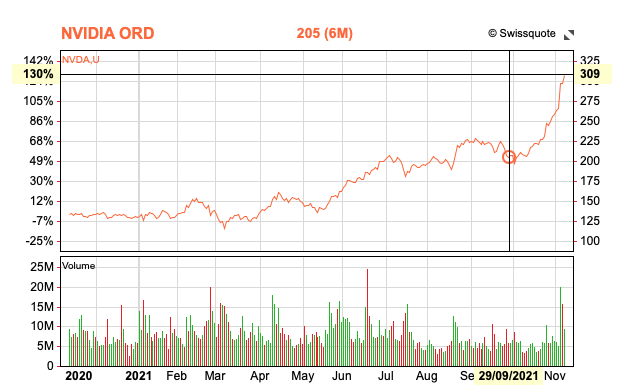

NVIDIA extends meteoric rally after optimistic conference updates

The stock hits a record high, extending the recent rally that helped it gain $ 250 billion last month.

As part of its new product event in the fall around the simulation technology "Omniverse", Nvidia boss Jensen Huang said that the company will start offering automakers a system called Drive Concierge.

Nvidia also publishes tools for software developers to help them create "metaverses" of three-dimensional virtual worlds

The stock has risen since Meta Platform, formerly Facebook's "metaverse" spending plans on Oct.25, a two-week gain almost as large as competitor Intel's $ 209 billion market cap

The CEO is clearly smart and the company is clearly a disruptor, ”Mirabaud Securities TMT analyst Neil Campling wrote in a recent note.

The online and cloud boom are boosting GOOGLE and MICROSOFT

* Alphabet with third record win in a row

* Microsoft's cloud division continues to grow strongly

The online boom accelerated by the Corona crisis is bringing both Google and Microsoft to brilliant business. While the Google owner Alphabet cemented its position as online advertising prime with a record profit in the third quarter, the world's largest software company Microsoft benefited from the high demand for storage space and applications in the cloud due to the trend towards hybrid working with switching between home and office. In contrast to Facebook and the Snapchat operator Snap, Google hardly felt the effects of Apple's new data protection rules.

LOGITHECH share under pressure after mixed Q2

The shares of Logitech started the trading day with significant losses. The computer accessories manufacturer from western Switzerland can look back on a difficult second quarter. In terms of gross margin and net income, the company missed analyst estimates for the first time in years. However, the confirmation of this year's growth and profit targets gives the experts a sigh of relief.

MONTH OUTLOOK

By mid-October, the stock markets had completed the late summer consolidation. Since then, there has been a rally in equities, driven primarily by good business figures and by driving the economic recovery.

Statistically, there are good stock market months ahead. In the short term, the stock markets are a bit overheated, which is why a breather would be called for.

Whether or not there is an end-of-year rally this year will likely depend on how current risk factors play out: the main theme of inflation; the long interest rates and the pandemic.

We expect a slight upward trend for November.

STOCK RECOMMENDATION

© 2021, Grimaldi & Partners AG